Students evaluate personal knowledge of credit, debit cards

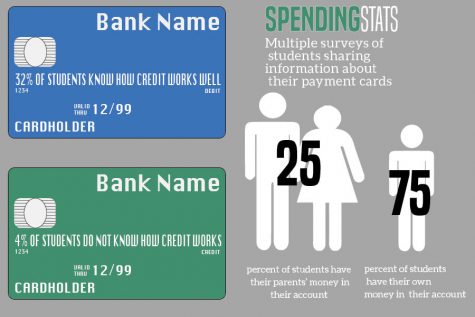

According to a survey of 133 students, only 32 percent think they fully understand how credit works

Most stores in Johnson County offer card readers, eliminating the need for paper money to be used to pay for goods or services.

March 23, 2017

As sophomore Ciara Pemberton swipes her debit card throughthe card reader at the cash register in the local grocery store, the purchase is made and the money is taken directly from her checking account.

Many students, including Pemberton, who got her debit card when she was 14, know exactly what occurs when they pay with a debit card or with cash — the payment is instantly done and the funds have been subtracted from the account.

“With debit, [the money] is taken straight from your account,” Pemberton said. “So I use a debit card because it’s easy to see my balance and refill it.”

Sophomore Ciara Pemberton pays for her groceries in the self checkout line.

However, not as many students are knowledgeable about how credit cards work. After high school, business teacher Patricia Brock says that students can sometimes end up signing up for cards with high interest rates they cannot afford.

“Once you enter college, a lot of credit card companies automatically give freshmen a credit card,” Brock said. “Their interest rate is probably going to be 20 percent, and they are going to have to make sure that it’s only used in emergencies and that it’s paid off quickly because that’s how people get into debt.”

These days, many millennials are aware of the damage that credit cards can cause financially, and according to a survey done by Bankrate, about 64 percent of Americans between ages 16 and 36 do not own a credit card.

In a survey out of 133 students at Mill Valley, about 10 percent of the students said that they own a credit card, while nearly 50 percent said they have a debit card.

Freshman Anna Paden is one of the students at Mill Valley that has a credit card. Although her parents pay for all of the purchases that she makes with it, Paden is aware of how her card works.

“It’s nice because if I want to, I can go shopping [with my credit card] and just buy things that I need,” Paden said. “You rack up so much [on the card] and at the end you have to pay that specific amount.

As opposed to debit cards, the user pays for the credit card transactions with money essentially borrowed from the bank. Every month or so, depending on how frequently the card is being used, the credit card holder will receive a bill for their charges along with the interest that has accumulated, which is payment to the bank for letting them use their money.

While credit is necessary to make larger purchases such as cars or homes, Brock thinks that students should be careful when using a credit card to accumulate credit.

“I think it is a good idea [to build credit],” Brock said. “But I think the understanding should be to borrow a hundred dollars to get some credit established, and don’t ever spend the hundred dollars and pay it back.”

Oftentimes, the card holder forgets that the money is borrowed and will have to be repaid with interest, which Brock says is a common problem.

“I think sometimes just seeing a piece of plastic, just like a debit card, you really don’t realize that you owe money,” Brock said. “It becomes very simple just to hand out your plastic, and next thing you know you owe $2000, $3000 or $4000 and up.”